WI Form 1952 2020-2025 free printable template

Show details

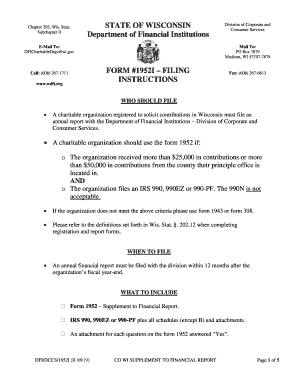

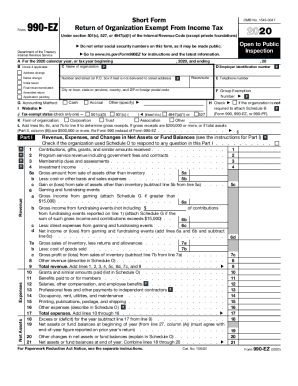

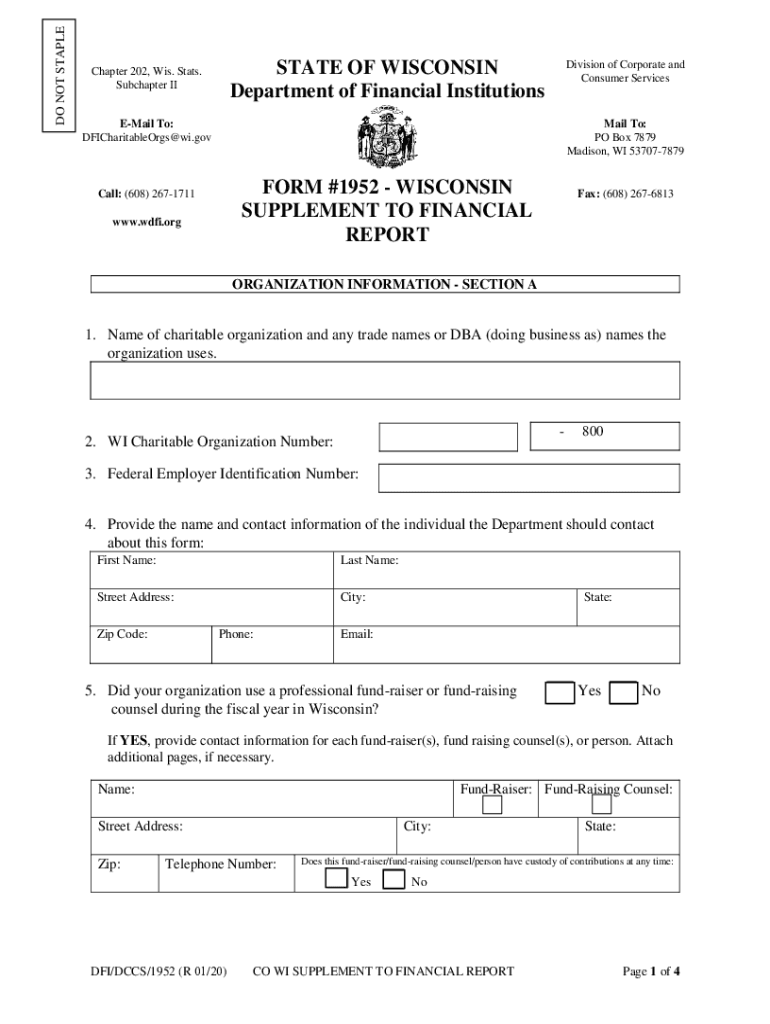

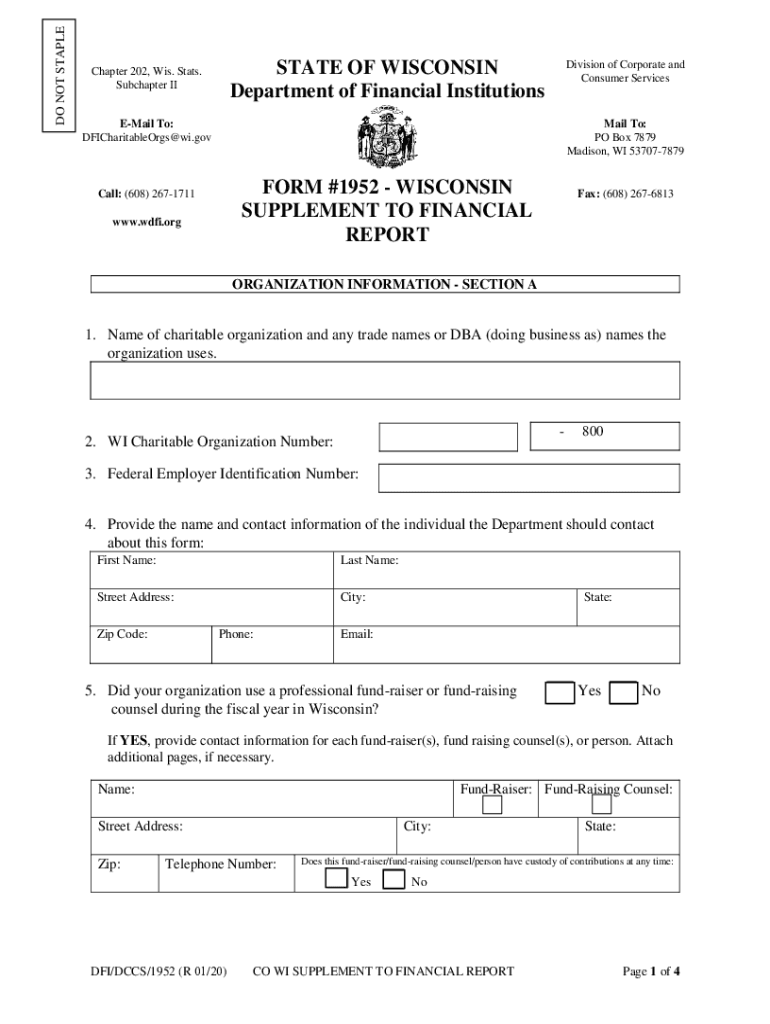

WHAT TO INCLUDE No part of submission should be stapled Form 1952 WISCONSIN Supplement to Financial Report. Gov Call 608 267-1711 www. wdfi. org Division of Corporate and Consumer Services PO Box 7879 Madison WI 53707-7879 FORM 1952I WISCONSIN FILING INSTRUCTIONS TO FINANCIAL REPORT Fax 608 267-6813 WHO SHOULD FILE A charitable organization registered to solicit contributions in Wisconsin must file an annual report with the Department of Financial Institutions Division of Corporate and o...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign wisconsin form 1952

Edit your wi form 1952 fillable form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 1952 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 1952 wisconsin online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit wi form 1952. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

WI Form 1952 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out pdffiller form

How to fill out WI Form 1952

01

Begin by downloading the WI Form 1952 from the official website or obtain a physical copy.

02

Fill in your personal information, including your name, address, and contact details at the top of the form.

03

Specify the type of request you are making in the designated section of the form.

04

Provide any additional information required, such as your Social Security number or tax identification number if applicable.

05

Review the form for completeness and accuracy.

06

Sign the form where indicated.

07

Submit the completed form according to the instructions provided, either by mail or online.

Who needs WI Form 1952?

01

Individuals or businesses seeking to file a particular claim or request with the Wisconsin Department of Revenue.

02

Residents of Wisconsin applying for certain tax-related requests or information.

Fill

wi 1952

: Try Risk Free

People Also Ask about the purpose of wi form compliance with state tax laws

What is simple filing?

A simple return is one that's filed using IRS Form 1040 only, without attaching any schedules.

What are 4 forms used in filing your taxes?

Form 1040. The U.S. Individual Income Tax Return is the bread and butter of tax forms -- the starting point for most taxpayers. Form 1040EZ. As the name suggests, the 1040EZ is a pretty basic individual filing tax form. Form 1040A. Form W-2. Form W-4. Form W-4P. Form 1099-MISC. Form 1098.

What is my IRS filing form?

Form 1040 is used by U.S. taxpayers to file an annual income tax return.

What are the three common forms for filing taxes?

There are three personal income tax forms — 1040, 1040A and 1040EZ — with each designed to get the appropriate amount of your money to the IRS.

What are 4 items you need to file your tax returns?

Bring all documents below. Photo ID. Social Security Cards, Social Security Number verification letters, or Individual Taxpayer Identification Number assignment letters for you, your spouse, and any dependents. Birth dates for you, your spouse, and dependents on the tax return.

What are four 4 types of forms on federal taxes?

Popular Forms, Instructions & Publications Form 1040-ES. Estimated Tax for Individuals. Form 1040-ES is used by persons with income not subject to tax withholding to figure and pay estimated tax. Form 941. Employer's Quarterly Federal Tax Return. Form SS-4. Application for Employer Identification Number (EIN)

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute wisconsin dfi form 1952 online?

pdfFiller has made it simple to fill out and eSign wisconsin form. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Can I create an electronic signature for the wisconsin forms in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your wisconsin dba in minutes.

How do I fill out wisconsin charitable solicitation registration using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign wisconsin llc annual report due date and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is WI Form 1952?

WI Form 1952 is a form used by the State of Wisconsin to report the income and franchise tax liabilities for corporations.

Who is required to file WI Form 1952?

Corporations that are registered in Wisconsin and are subject to income and franchise taxes are required to file WI Form 1952.

How to fill out WI Form 1952?

To fill out WI Form 1952, gather the necessary financial information, complete sections related to income and deductions, and provide accurate data as required by the form instructions.

What is the purpose of WI Form 1952?

The purpose of WI Form 1952 is to calculate and report the income tax for corporations operating in Wisconsin, ensuring compliance with state tax laws.

What information must be reported on WI Form 1952?

The information that must be reported on WI Form 1952 includes total income, deductions, tax credits, and any other pertinent financial data related to corporate operations in Wisconsin.

Fill out your WI Form 1952 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

How To Fill Out A 401k Distribution Form is not the form you're looking for?Search for another form here.

Keywords relevant to online records

Related to wisconsin short form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.