Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Filing a form typically refers to completing and submitting a document or application to an appropriate authority or organization. It often involves providing information or details required by law or regulation. Filing forms are commonly used for various purposes such as taxes, permits, licenses, registrations, applications, and legal documents. The form must typically be filled out accurately and completely before being submitted.

Who is required to file filing form?

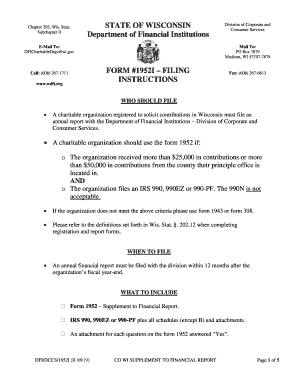

The individuals or entities who are required to file a filing form will depend on the specific context and purpose of the form. In general, filing forms are most commonly associated with tax returns and financial disclosures.

For tax purposes, individuals who earn above a certain income threshold, as determined by the tax laws of their country, may be required to file a tax return and related forms. Additionally, businesses and organizations, such as corporations, partnerships, and non-profit entities, may also need to file tax forms.

In terms of financial disclosures, individuals holding certain positions, such as company executives or government officials, may be required to file forms detailing their financial holdings, income, and other relevant information.

It is important to consult the specific laws and regulations relevant to the filing form in question to determine who exactly is required to file.

How to fill out filing form?

Filling out a filing form may vary depending on the specific form you are working with. However, here are some general steps to follow:

1. Read the instructions: Start by carefully reading the instructions provided with the form. It will give you an overview of what information is required and how to fill out the form correctly.

2. Gather necessary information: Collect all the information and documents needed to complete the form. This may include personal details, financial information, supporting documents, or any other relevant data.

3. Provide accurate information: Make sure to provide accurate and complete information in the form. Double-check the data you enter to avoid errors.

4. Follow the format: Pay attention to the specific format the form requires. Fill in the information using the designated fields, checkboxes, or spaces provided. Enter the information in a legible manner using black or blue ink.

5. Provide additional documents: If there are supporting documents required, ensure you attach or enclose them along with the form.

6. Review and proofread: Once you have completed the form, review it carefully for any mistakes, omissions, or inaccuracies. Proofread all the information before submitting the form.

7. Sign and date: If a signature and date are required, ensure that you sign and date the form in the designated area. Make sure the signature matches any provided examples or requirements.

8. Make copies: Before submitting the form, it's advisable to make copies for your own records. Retain a copy of the filled-out form and any supporting documents.

9. Submit the form: Finally, submit the form as specified in the instructions. This could involve mailing it, submitting it online, or delivering it in person to the appropriate organization or authority.

Note: Filling out official forms can sometimes be complex or confusing. If you are uncertain about any aspect or have specific questions, consider seeking assistance from a professional or contacting the specific authority or organization that issued the form.

What is the purpose of filing form?

The purpose of filing a form is to provide accurate and necessary information to a relevant authority or organization for various purposes, such as:

1. Regulatory Compliance: Forms are used to ensure compliance with laws, regulations, and reporting requirements imposed by government bodies or agencies.

2. Documentation: Forms serve as a means of documenting important data or transactions for various entities, such as businesses, individuals, or government agencies. This documentation can be used for legal, administrative, or record-keeping purposes.

3. Information Gathering: Forms are used to gather specific information from individuals, businesses, or organizations. This information may be required for statistical analysis, research, planning, or decision-making processes.

4. Application or Enrollment: Many forms are used for applications, enrollments, or registrations, such as applying for a job, enrolling in a school or university, applying for grants or licenses, or signing up for services or memberships.

5. Financial Purposes: Forms may be used for financial matters, such as filing tax returns, reporting income or expenses, applying for loans or mortgages, or managing investments.

6. Communication: Forms can serve as a means of communication between various parties. For example, complaint forms can be used to communicate grievances, feedback forms can be used to give suggestions or opinions, and order forms can be used to request products or services.

Overall, the purpose of filing a form is to provide accurate and complete information for the intended purpose, whether it be for compliance, documentation, information gathering, applications, financial purposes, or communication.

What information must be reported on filing form?

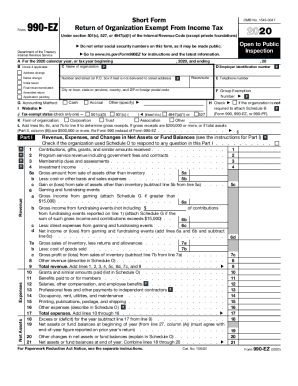

The information that must be reported on a filing form can vary depending on the type of form and the purpose of the filing. However, some common information that is often required to be reported includes:

1. Personal information: This may include the filer's name, address, phone number, email address, and any other relevant contact details.

2. Identification details: Certain forms may require identification information such as a Social Security number, tax identification number, or employer identification number.

3. Financial information: This can include details about income, assets, and liabilities. For example, forms related to taxes may require reporting of income sources, deductions, and credits. Forms related to financial transactions or investments may require reporting of account numbers, transaction details, and values.

4. Employment information: If the filing form pertains to employment, it may require reporting of employer names, job titles, income details, and any other relevant employment information.

5. Legal information: Some forms may require reporting of any legal proceedings or criminal history, if applicable.

6. Supporting documentation: Depending on the type of filing form, supporting documentation may need to be attached to support the reported information. This could include documents such as receipts, bank statements, or legal documents.

It is important to carefully review the specific instructions for the filing form in order to ensure that all required information is reported accurately and completely.

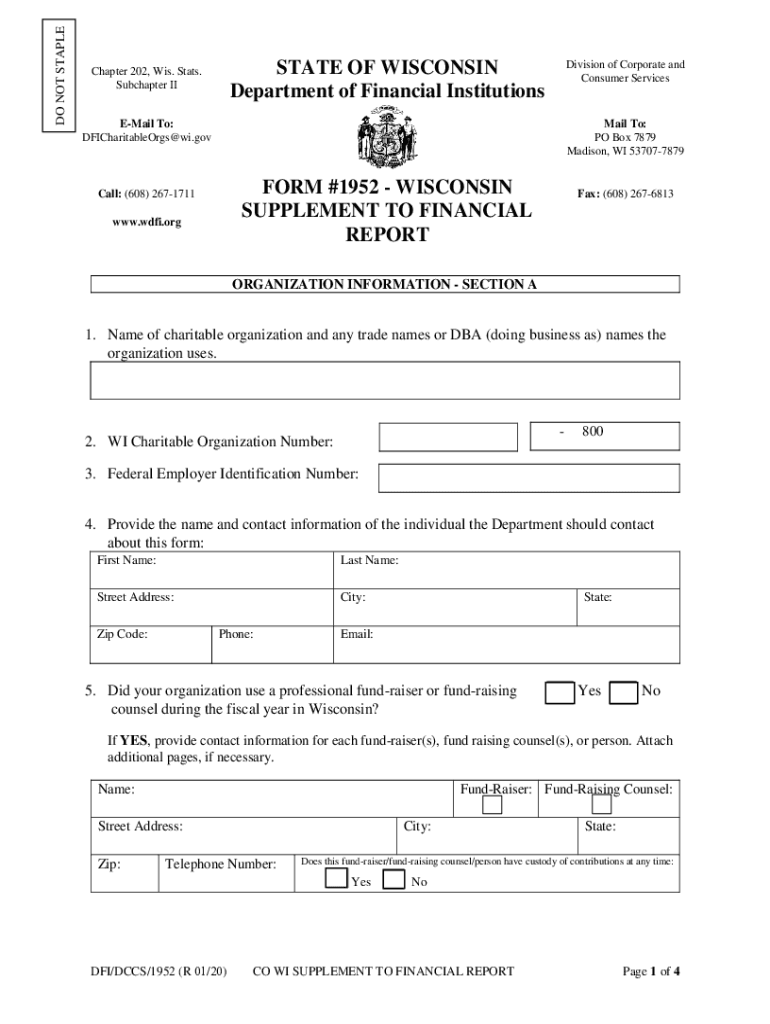

How do I execute wisconsin form report pdf online?

pdfFiller has made it simple to fill out and eSign wi form report fill. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Can I create an electronic signature for the wi form 1952 in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your wisconsin form 1952 in minutes.

How do I fill out wisconsin 1952 form using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign filing form and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.